-

By Greg Gordon | McClatchy Newspapers

WASHINGTON — Henry Paulson has received widespread acclaim for his bare-knuckled decision-making as the treasury secretary at the peak of the 2008 financial crisis, but former federal regulators say he missed multiple chances to contain the disaster.

Among the prime beneficiaries of Paulson's inaction in 2006 and 2007 was Goldman Sachs, the investment banking behemoth he ran before he was named to former President George W. Bush's Cabinet.

Paulson's failure to take steps to curb risky mortgage lending also enabled top executives of other Wall Street firms to continue cashing big bonus checks, while less privileged Americans lost their jobs, their homes and their retirement savings in the worst economic catastrophe since the Great Depression.

Paulson and Federal Reserve Chairman Ben Bernanke have been widely praised for engineering the Wall Street bailouts, which avoided systemic chaos, and they'll probably get more plaudits if the government recovers much of the $400 billion in loans it made to financial institutions.

However, while Paulson has been criticized, unfairly or not, because $12.9 billion of the bailout money went to Goldman, he's drawn little scrutiny for what he did in his first 18 months in office, during the final frenzied stages of the housing bubble.

* "No one was better positioned . . . than Mr. Paulson to understand exactly what the implications of his moving against the (housing) bubble would have been for Goldman Sachs, because he knew what the Goldman Sachs positions were," said William Black, a former senior thrift regulator who delivered the harshest criticism of the former secretary.

Paulson "knew that if he acted the way he should, that would have burst the bubble. Then Goldman Sachs would have been left with a very substantial loss, and that would have been the end of bonuses at Goldman Sachs."

Con't..

*******

*Gee..It's about time these guys caught up..

Better late then never..

skip to main |

skip to sidebar

May love and laughter light your days,

and warm your heart and home.

May good and faithful friends be yours,

wherever you may roam.

May peace and plenty bless your world

with joy that long endures.

May all life's passing seasons

bring the best to you and yours !

*******

Thanks Pbtrue1. :)

May love and laughter light your days,

and warm your heart and home.

May good and faithful friends be yours,

wherever you may roam.

May peace and plenty bless your world

with joy that long endures.

May all life's passing seasons

bring the best to you and yours !

*******

Thanks Pbtrue1. :)

No big surprise..

“Opening up the health insurance market to more vigorous nationwide competition, as we have done over the last decade in banking, would provide more choices of innovative products less burdened by the worst excesses of state-based regulation.”

- John McCain

Scooter Skates !!

.

.

Quotes

“I’ll believe corporations are people when Texas executes one.”

— Seen on Democracy Now! at the Occupy Wall Street rally.

**

Thanks to Robert S

Bartcop.com

--

— Seen on Democracy Now! at the Occupy Wall Street rally.

**

Thanks to Robert S

Bartcop.com

--

** Please leave a Comment if you feel so inclined..

Would enjoy hearing from you..Thx.. :)

*******

**Marc Maron is in no way Affiliated with this site**

Would enjoy hearing from you..Thx.. :)

*******

**Marc Maron is in no way Affiliated with this site**

For Laurie :)

Yep,and a Beautiful Woman..

And, I could make her laugh..She use to laugh at all my

jokes..Well,most of them ;)

She passed away..

about 12 years ago,Unfortunately..

She was a Beautiful Woman....

She was My Wife..

I miss Her very much.......

--

And, I could make her laugh..She use to laugh at all my

jokes..Well,most of them ;)

She passed away..

about 12 years ago,Unfortunately..

She was a Beautiful Woman....

She was My Wife..

I miss Her very much.......

--

May love and laughter light your days,

and warm your heart and home.

May good and faithful friends be yours,

wherever you may roam.

May peace and plenty bless your world

with joy that long endures.

May all life's passing seasons

bring the best to you and yours !

*******

Thanks Pbtrue1. :)

May love and laughter light your days,

and warm your heart and home.

May good and faithful friends be yours,

wherever you may roam.

May peace and plenty bless your world

with joy that long endures.

May all life's passing seasons

bring the best to you and yours !

*******

Thanks Pbtrue1. :)

"So keep fightin' for freedom and justice, beloveds, but don't you forget to have fun doin' it.

Lord, let your laughter ring forth.

Be outrageous, ridicule the fraidy-cats, rejoice in all the oddities that freedom can produce.

And when you get through kickin' ass and celebratin' the sheer joy of a good fight, be sure to tell those who come after how much fun it was."

Molly Ivins

Lord, let your laughter ring forth.

Be outrageous, ridicule the fraidy-cats, rejoice in all the oddities that freedom can produce.

And when you get through kickin' ass and celebratin' the sheer joy of a good fight, be sure to tell those who come after how much fun it was."

Molly Ivins

About Me

Facebook Badge

Followers ? Who Woulda Thunk It ? ;-)

Search This Blog

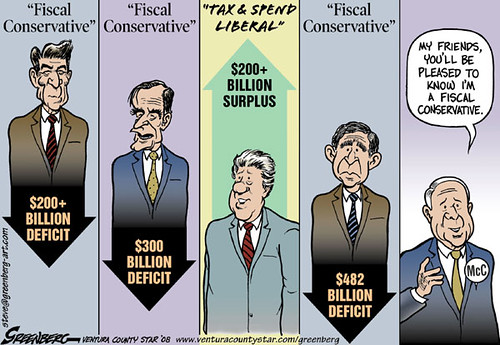

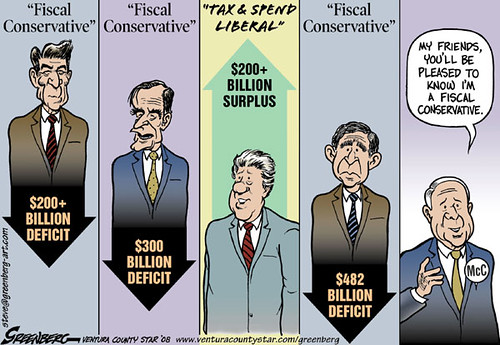

The Debt Ceiling

GOP voted for excessive spending under Bush, but don't want to raise the debt ceiling to pay the bill.

President Obama has agreed to extend the Bush-era tax cuts. Because if there’s anything we need, it’s an extension of the Bush era.

- David Letterman

- David Letterman

Maron--This shirt is from my fan Katy at Cat Fancy Magazine. It's not too girly is it ?

"To practice any art, no matter how well or badly, is a way to make your soul grow. So do it."

- Kurt Vonnegut

- Kurt Vonnegut

Always Remember This Bit Of Common Sense..

EVERY VOTE is sent thru the telephone/computer lines, so

EVERY VOTE is Hackable !

EVERY VOTE is Hackable !

Quotes

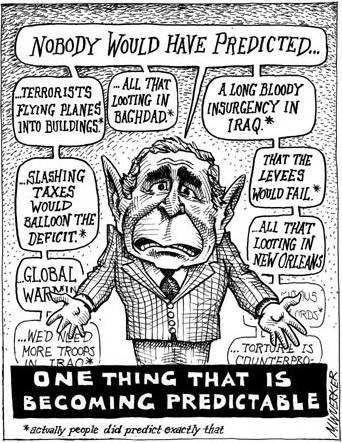

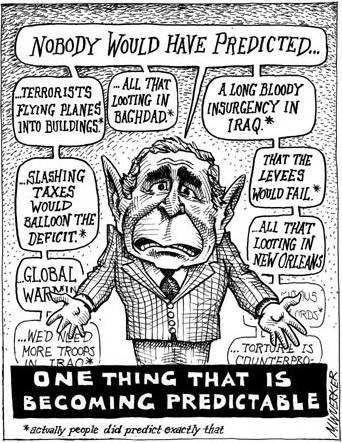

"It's interesting what former presidents do when they leave office.

Bush is now working as a motivational speaker.

And if you want to be motivated, who better to turn to than the guy who invaded the wrong country and started a depression."

-- Letterman

Bush is now working as a motivational speaker.

And if you want to be motivated, who better to turn to than the guy who invaded the wrong country and started a depression."

-- Letterman

Links

- A Nation Deceived.org - Podcast-David Swanson

- ACLU.org

- Act Blue.com

- Addicting Info.org

- Affordable Single-Payer National Health Insurance

- Afterdowningstreet.org

- Air America Place

- All Hat No Cattle.net

- Americablog

- Amped Status.Com

- Atrios

- BajaMichael MySpace

- Barack Obama.com

- Bartcop.com

- Be Bop Deluxe at Last.FM

- Berkeley Breathed.com

- Blue Roots Radio (New) Blog

- Blueroots Radio

- Bob - A Moment With Bob

- Boing Boing.net

- Bradblog.com

- Brilliant at Breakfast

- C-Span 3 Watch Live

- Camp Butch

- Cat In Bag

- Center For Investigative Reporting.Org

- Change Congress.org

- Cindy Sheehan For Congress.org

- Cliff Schecter - Campaign Silo at FireDogLake

- Cliff Schecter - The Political Carnival

- Coast to Coast AM

- ConsortiumNews.Com

- CREW

- Crooks and Liars

- Dangerous Minds.net

- Democracy Now.Org

- Democratic Underground.Com

- Diebold Return Our Money.com

- Dirty Energy Money !

- Election Protection

- Election Protection.org

- Emptywheel

- Ersatz Blogger

- Fact Check.org

- Fair.Org

- Fire Dog Lake

- Fix Congress First.Org

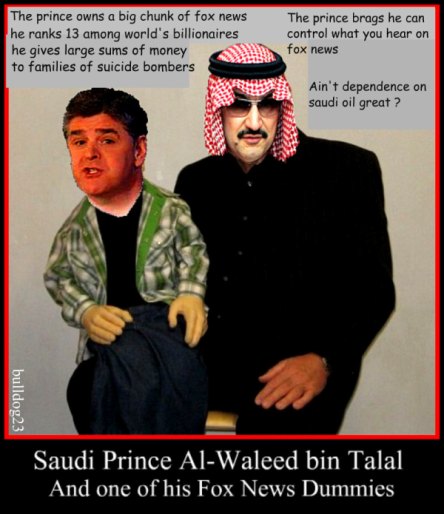

- Fox Attacks.Com

- Fox News Boycott.Com

- Free Democracy.com

- Fuck Conservatives

- Gin Blossoms-myspace

- Glenn Greenwald

- Go Left TV.com

- Goddessdelirious

- Great News Network.org

- Greg Palast

- GRITtv with Laura Flanders

- Happe Talk Show

- Head On Radio !

- Health Care-Now.org

- Health Justice

- Hullabaloo

- If I Ran The Zoo

- Infonistacrat

- Jeff Farias Show.Com

- JFK Assassination--Open Mic

- Jim Earl

- Jim Earl - The Clutter Family - MySpace

- Joe Conason Blog - Observer.com

- Jonathan Turley

- Katie Halper.com

- Kent Jones Now

- Kiss My Big Blue Butt

- Liberal Oasis

- Liberal Talk Radio

- Lies-The Iraq War Card-935 Lies

- Living Liberally.org

- LumpinProllie

- Marc Maron

- Marc Maron MySpace Page

- Marc Maron WTF Pod.Com

- Marc Maron-A Special Thing

- Maron v Seder Show

- Maron Vision

- McClatchy DC.Com

- Media Matters Action.org

- Media Matters.org

- Michele Happe MA LADC

- Mike Malloy

- Morning Seditionists

- Morning Seditionists Archives

- Morning Seditionists Radio

- Move Your Money

- Mr.Drinkwater Cartoons

- Music Oasis

- Music Oasis - Part Deux! Whoo-hoo!

- MyOpenMic's

- Nova Exile Radio.com

- Old American Century.org

- Open Congress.org-Track Congressional Bills

- Open Secrets.Org

- Or So It Seems

- Peace Takes Courage.com

- Peter B Collins Show.Com

- PoliticusUSA

- Proligarchy

- Radio Nigel

- Radio On The Edge

- RanchoLaLuna

- Ring Of Fire Radio.com

- Rip Coco

- Sam Seder - Majority Report Radio.com

- Sam Seder - That's Bullshit

- Sam Seder Show

- Sammy & Marc VOD

- Sederville - The Directory

- Shadow Government Statistics

- Sleeps with Butterflies

- Some Of Nothing.com

- SplashCast

- Stop Big Media.com

- Strangebedfellows

- Sweet Alyce

- Sweet Jesus I Hate Bill O'Reilly

- Sweet Jesus I Hate Chris Matthews

- Talking Points Memo

- The Coalition for Accountability in Political Spending

- The Goddess Randi Rhodes

- The Jeff Farias Show

- The Majority Report with Sam Seder

- The Memory Hole

- The Nation

- The Public Record

- The Real News

- The Reasonist

- The Rude Pundit

- The Side Show

- The Skeleton Closet

- The Snot Green Sea

- The Young Turks

- ToniD's Ya Think ?

- Truthdig.Com - (Chris Hedges)

- Tv News Lies.Org

- Under The Lobster Scope

- Velvet Revolution.US

- Voters Unite.Org

- Wave Of The Future

- WE ARE CITIZEN RADIO.Com

- WhitelightBlacklight

- Who is holding the LipStick ?

- Wonkette

- Woodistry "Artistry in Wood"

- WOXY.Com-Vintage Radio

”If everyone demanded peace instead of another television set, then there’d be peace.”

~ John Lennon

~ John Lennon

Lies Are Costly..Both in Lives and Monetarily..

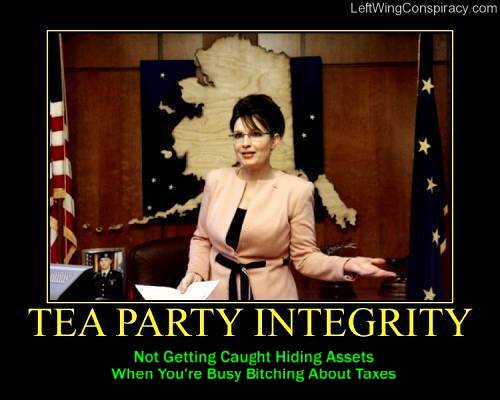

The Future Of The Teabaggin Wingnuts..

No big surprise..

Rapture Ready Caribou Barbie

How to deal with Repub assholes..

Just ask them how that unitary executive thing is working for them now.

"Sorry guy, but if the president did it, that makes it right. It was that way with Dubya

and his co-executive. It should be that way under Obama, too. Right? Oh, and if you're

not with us, you're against us. Love it or leave it. Let's roll."

--Steve in MT

www.bartcop.com

"Sorry guy, but if the president did it, that makes it right. It was that way with Dubya

and his co-executive. It should be that way under Obama, too. Right? Oh, and if you're

not with us, you're against us. Love it or leave it. Let's roll."

--Steve in MT

www.bartcop.com

Domestic Surveillance !

Get A Room !

The Fannie Mae/Freddie Mac takeover by the government.

Yeah...The wonder of De-Regulation and the Free Market.

The Big guys get bailed out and Families end up living in their cars.

Privatize The Profits & Socialize The Loses !

Thanks Chubbs.. :)

Yeah...The wonder of De-Regulation and the Free Market.

The Big guys get bailed out and Families end up living in their cars.

Privatize The Profits & Socialize The Loses !

Thanks Chubbs.. :)

QUOTE OF THE Month..

“Opening up the health insurance market to more vigorous nationwide competition, as we have done over the last decade in banking, would provide more choices of innovative products less burdened by the worst excesses of state-based regulation.”

- John McCain

A Powerful and Truthful Statement..

"If we do not change course and stand up for our Constitution, for what is best in America, for what we know is right and just, then history will most certainly decide that it was those of us in this body who bear equal responsibility for the President's decisions -- for it was us who looked the other way, time and time again."

-- Senator Christopher Dodd,

July 8, 2008, on the Senate floor during debate of the re-authorization of the Foreign Intelligence Surveillance Act (FISA).

-- Senator Christopher Dodd,

July 8, 2008, on the Senate floor during debate of the re-authorization of the Foreign Intelligence Surveillance Act (FISA).

Quote of the Day..

My conclusion about $4 a gallon gas?

Just divide eight years by two oilmen in theWhite House and you have your $4 a gallon."

-- Barbara Boxer,

Link

Just divide eight years by two oilmen in theWhite House and you have your $4 a gallon."

-- Barbara Boxer,

Link

George W."Thank God He's Gone" Bush

About That Clicking on Your Phone

The Latest Picture From Mars !

Impeach Bush and Cheney

Marc Maron

Lie by Lie--Bush War Timeline

Submitted by MMRules on Sun, 09/16/2007 - 12:45am

Pretty cool..Especially if you haven't seen it before..

Motherjones.com:

In this timeline, we've assembled the history of the Iraq War to create a resource we hope will help resolve open questions of the Bush era. What did our leaders know and when did they know it? And, perhaps just as important, what red flags did we miss, and how could we have missed them? This is the second installment of the timeline, with a focus on how the war was lost in the first 100 days.

Bush War Timeline

.

"Hello to our friends and fans in domestic surveillance."

.

"Hello to our friends and fans in domestic surveillance."

.

"Hello to our friends and fans in domestic surveillance."

.

"Hello to our friends and fans in domestic surveillance."

Wouldn't It Be Great !!

I m p e a c h !!

And what does the Constitution say that we do when the Executive Branch is in contempt of Congress, class ?

My Blogger Panel

Scooter Skates !!

FEEDJIT Live Traffic Feed

Fact Check

Smarter Than Bushtard,McSame and Moosebutt..

World Peace

oh

Submitted by Alice on Sun, 08/05/2007 - 3:19am.

and what makes you happy?

*Hee Hee*

Submitted by Alice on Sun, 08/05/2007 - 4:02am.

MM.. :)

*Hee Hee*

Submitted by Alice on Sun, 08/05/2007 - 4:02am.

MM.. :)

*Hee Hee*

Submitted by Alice on Sun, 08/05/2007 - 4:02am.

MM.. :)

*Hee Hee*

Submitted by Alice on Sun, 08/05/2007 - 4:02am.

MM.. :)

Chickenhawk !

I'm Eighteen (Album Version)

I'm Eighteen (Album Version)