-

THE MOST CORRUPT MEMBERS OF CONGRESS: “UNFINISHED BUSINESS” | CREW's Most Corrupt Members of Congress

Wednesday, October 13, 2010

Monday, October 11, 2010

How Hank Paulson’s inaction helped Goldman Sachs

-

By Greg Gordon | McClatchy Newspapers

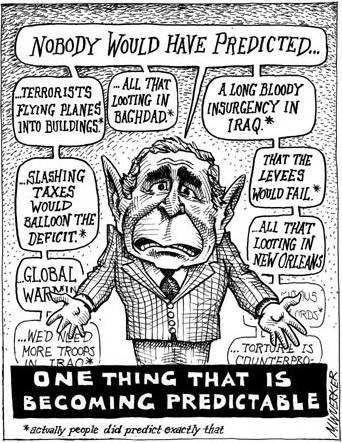

WASHINGTON — Henry Paulson has received widespread acclaim for his bare-knuckled decision-making as the treasury secretary at the peak of the 2008 financial crisis, but former federal regulators say he missed multiple chances to contain the disaster.

Among the prime beneficiaries of Paulson's inaction in 2006 and 2007 was Goldman Sachs, the investment banking behemoth he ran before he was named to former President George W. Bush's Cabinet.

Paulson's failure to take steps to curb risky mortgage lending also enabled top executives of other Wall Street firms to continue cashing big bonus checks, while less privileged Americans lost their jobs, their homes and their retirement savings in the worst economic catastrophe since the Great Depression.

Paulson and Federal Reserve Chairman Ben Bernanke have been widely praised for engineering the Wall Street bailouts, which avoided systemic chaos, and they'll probably get more plaudits if the government recovers much of the $400 billion in loans it made to financial institutions.

However, while Paulson has been criticized, unfairly or not, because $12.9 billion of the bailout money went to Goldman, he's drawn little scrutiny for what he did in his first 18 months in office, during the final frenzied stages of the housing bubble.

* "No one was better positioned . . . than Mr. Paulson to understand exactly what the implications of his moving against the (housing) bubble would have been for Goldman Sachs, because he knew what the Goldman Sachs positions were," said William Black, a former senior thrift regulator who delivered the harshest criticism of the former secretary.

Paulson "knew that if he acted the way he should, that would have burst the bubble. Then Goldman Sachs would have been left with a very substantial loss, and that would have been the end of bonuses at Goldman Sachs."

Con't..

*******

*Gee..It's about time these guys caught up..

Better late then never..

By Greg Gordon | McClatchy Newspapers

WASHINGTON — Henry Paulson has received widespread acclaim for his bare-knuckled decision-making as the treasury secretary at the peak of the 2008 financial crisis, but former federal regulators say he missed multiple chances to contain the disaster.

Among the prime beneficiaries of Paulson's inaction in 2006 and 2007 was Goldman Sachs, the investment banking behemoth he ran before he was named to former President George W. Bush's Cabinet.

Paulson's failure to take steps to curb risky mortgage lending also enabled top executives of other Wall Street firms to continue cashing big bonus checks, while less privileged Americans lost their jobs, their homes and their retirement savings in the worst economic catastrophe since the Great Depression.

Paulson and Federal Reserve Chairman Ben Bernanke have been widely praised for engineering the Wall Street bailouts, which avoided systemic chaos, and they'll probably get more plaudits if the government recovers much of the $400 billion in loans it made to financial institutions.

However, while Paulson has been criticized, unfairly or not, because $12.9 billion of the bailout money went to Goldman, he's drawn little scrutiny for what he did in his first 18 months in office, during the final frenzied stages of the housing bubble.

* "No one was better positioned . . . than Mr. Paulson to understand exactly what the implications of his moving against the (housing) bubble would have been for Goldman Sachs, because he knew what the Goldman Sachs positions were," said William Black, a former senior thrift regulator who delivered the harshest criticism of the former secretary.

Paulson "knew that if he acted the way he should, that would have burst the bubble. Then Goldman Sachs would have been left with a very substantial loss, and that would have been the end of bonuses at Goldman Sachs."

Con't..

*******

*Gee..It's about time these guys caught up..

Better late then never..

Tuesday, October 5, 2010

Monday, October 4, 2010

Racial Predatory Loans `Fueled U.S. Housing Crisis: Study

-

Duh !

You might want to show this Study to the GOP & the M$M/Corporate Media !

*******

By Nick Carey Nick Carey – Mon Oct 4,

CHICAGO (Reuters) – Predatory lending aimed at racially segregated minority neighborhoods led to mass foreclosures that fueled the U.S. housing crisis, according to a new study published in the American Sociological Review.

Predatory lending typically refers to loans that carry unreasonable fees, interest rates and payment requirements.

Poorer minority areas became a focus of these practices in the 1990s with the growth of mortgage-backed securities, which enabled lenders to pool low- and high-risk loans to sell on the secondary market, Professor Douglas Massey of the Woodrow Wilson School of Public and International Affairs at Princeton University and PhD candidate Jacob Rugh, said in their study.

The financial institutions likely to be found in minority areas tended to be predatory -- pawn shops, payday lenders and check cashing services that "charge high fees and usurious rates of interest," they said in the study.

"By definition, segregation creates minority dominant neighborhoods, which, given the legacy of redlining and institutional discrimination, continue to be underserved by mainstream financial institutions," the study says.

Redlining is the practice of denying or increasing the cost of services, such as banking and insurance, to residents in specific areas, often based on race.

The U.S. economy is still struggling with the effects of its longest recession since the 1930s, which was triggered in large part by the housing crisis, which was in part triggered by the crash of the subprime loan market.

Con't..

Duh !

You might want to show this Study to the GOP & the M$M/Corporate Media !

*******

By Nick Carey Nick Carey – Mon Oct 4,

CHICAGO (Reuters) – Predatory lending aimed at racially segregated minority neighborhoods led to mass foreclosures that fueled the U.S. housing crisis, according to a new study published in the American Sociological Review.

Predatory lending typically refers to loans that carry unreasonable fees, interest rates and payment requirements.

Poorer minority areas became a focus of these practices in the 1990s with the growth of mortgage-backed securities, which enabled lenders to pool low- and high-risk loans to sell on the secondary market, Professor Douglas Massey of the Woodrow Wilson School of Public and International Affairs at Princeton University and PhD candidate Jacob Rugh, said in their study.

The financial institutions likely to be found in minority areas tended to be predatory -- pawn shops, payday lenders and check cashing services that "charge high fees and usurious rates of interest," they said in the study.

"By definition, segregation creates minority dominant neighborhoods, which, given the legacy of redlining and institutional discrimination, continue to be underserved by mainstream financial institutions," the study says.

Redlining is the practice of denying or increasing the cost of services, such as banking and insurance, to residents in specific areas, often based on race.

The U.S. economy is still struggling with the effects of its longest recession since the 1930s, which was triggered in large part by the housing crisis, which was in part triggered by the crash of the subprime loan market.

Con't..

Sunday, October 3, 2010

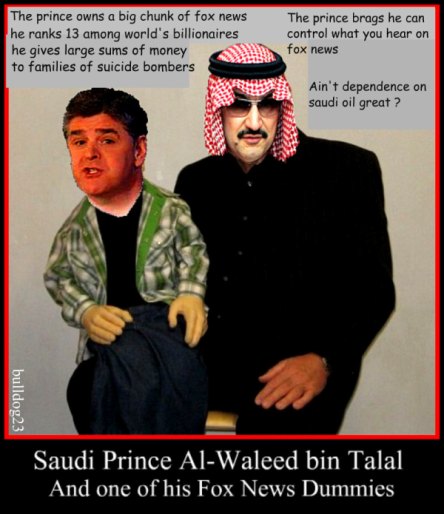

Feds Sue Fox News Over Reporter Catherine Herridge's Charges Of Discrimination, Retaliation

-

By SAM HANANEL

WASHINGTON — Federal authorities are suing the Fox News Network for allegedly retaliating against a reporter after she complained about unequal pay and job conditions based on her gender and age.

The Equal Employment Opportunity Commission says Fox News Channel reporter Catherine Herridge filed an internal complaint about allegedly discriminatory practices in 2007.

Con't..

*Thanks,ToniD..

`

By SAM HANANEL

WASHINGTON — Federal authorities are suing the Fox News Network for allegedly retaliating against a reporter after she complained about unequal pay and job conditions based on her gender and age.

The Equal Employment Opportunity Commission says Fox News Channel reporter Catherine Herridge filed an internal complaint about allegedly discriminatory practices in 2007.

Con't..

*Thanks,ToniD..

`

Subscribe to:

Posts (Atom)

.

.

May love and laughter light your days,

and warm your heart and home.

May good and faithful friends be yours,

wherever you may roam.

May peace and plenty bless your world

with joy that long endures.

May all life's passing seasons

bring the best to you and yours !

*******

Thanks Pbtrue1. :)

May love and laughter light your days,

and warm your heart and home.

May good and faithful friends be yours,

wherever you may roam.

May peace and plenty bless your world

with joy that long endures.

May all life's passing seasons

bring the best to you and yours !

*******

Thanks Pbtrue1. :)

.

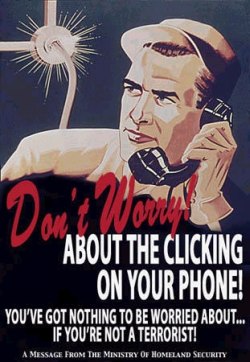

"Hello to our friends and fans in domestic surveillance."

.

"Hello to our friends and fans in domestic surveillance."

*Hee Hee*

Submitted by Alice on Sun, 08/05/2007 - 4:02am.

MM.. :)

*Hee Hee*

Submitted by Alice on Sun, 08/05/2007 - 4:02am.

MM.. :)

I'm Eighteen (Album Version)

I'm Eighteen (Album Version)